Economic literacy, the ability to use basic economic concepts to make decisions about earning, saving, spending, and sharing money, is a critical life skill. As with reading and writing, a working knowledge of basic economic concepts is essential for future success.

Regardless of her background, a girl is likely to work for pay for much of her adult life, and, at some point, she is likely to be responsible for her own financial well-being.

Still, girls today tend to be taught their role is that of the caregiver and nurturer, while boys tend to be taught they are to be providers, which includes managing finances. In turn, when girls grow up and earn wages, they are less likely to know how to manage their finances.

It is critical that girls have the support and skills to enhance their financial competence and confidence, and to exercise control over their financial future. Additionally, given long-standing gender disparity in pay and income, it is also critical that girls gain a sense of economic justice so they can better understand and assert their rights, and those of other girls and women, their families, and their communities.

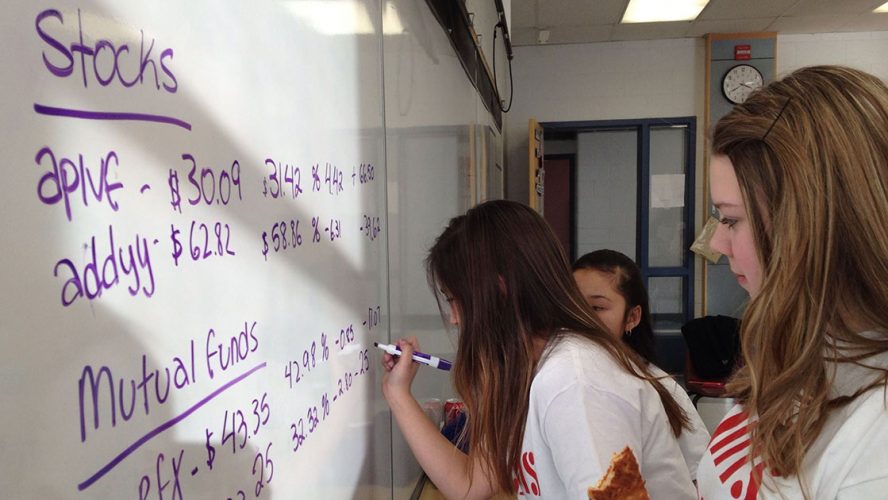

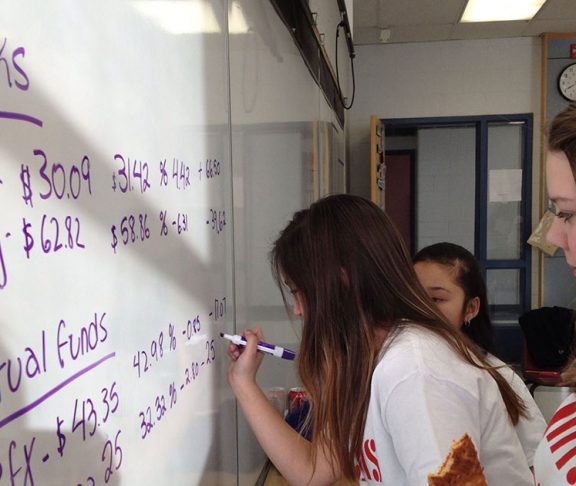

Start early

Understanding economic concepts can and should start young. From an early age, girls can start identifying what money is used for, differentiating between wants and needs, and talking about budgeting, saving, spending, and giving.

Putting girls in charge of their own finances, through an allowance or a monetary gift, will help teach these concepts. Talk about decisions, help her understand possible results, and follow up by discussing the decisions she made, and what they have impacted.

Education in the modern world

In today’s world of digital financial transactions, it’s become more challenging to understand financial concepts. It’s no longer a world of “what you have in your pocket is what you can spend.” You can help a girl understand money by using real coins and bills to reinforce basic concepts until she is able to understand the more abstract world of digital transactions.

By building the right foundation, girls will be empowered to make the best financial decisions, feel confident about making future decisions, and feel in control of choices — critical steps to developing into empowered, experienced, and economically successful adults.

Penn Sheppard, Director of Learning, Girls Inc., [email protected]